The Defensive Indicator Strategy

How a retirement portfolio can WIN by NOT LOSING

When losses hit harder in retirement, market volatility is not your friend

“Buy and Hold”, more accurately described as “Buy and Hope” is not an acceptable strategy as investors approach retirement or are already living in retirement.

During retirement, stock market losses, when combined with account withdrawals, can absolutely decimate your retirement dreams. While it is absolutely correct that over the long-term you should earn positive stock market returns, the “long-term” must be defined as 20 or 30 years or longer. When we are 60 or older and will be living off our investments now or in the very near future, we no longer have the luxury of time to let our stock market losses recover to previous values.

Stock market losses that happen early in retirement can seriously damage your retirement an unfortunate phenomenon known as the Sequence of Returns.

Since 1926, there have been eight bear markets, ranging in length from six months to 2.8 years, and in severity from a loss of 21.8% to as much as an 83.4% decline in value, as measured by the S&P 500. As an example, let’s use a 2 year, 24% drop in the value of the broad-based S&P 500. For simplicity sake, let’s also assume that the 24% drop in value occurs at the rate of 1% per month over the 24 months of this example.

This retired client has a $1,000,000 stock market portfolio and needs to take out $4,000 per month from this portfolio to maintain her lifestyle. Let’s also assume that it takes 5 years after the 2 year bear market to recover the lost 24%. Finally, since there is always inflation of some sort, let’s assume that at the end of each year it costs 3% more to live than the year before.

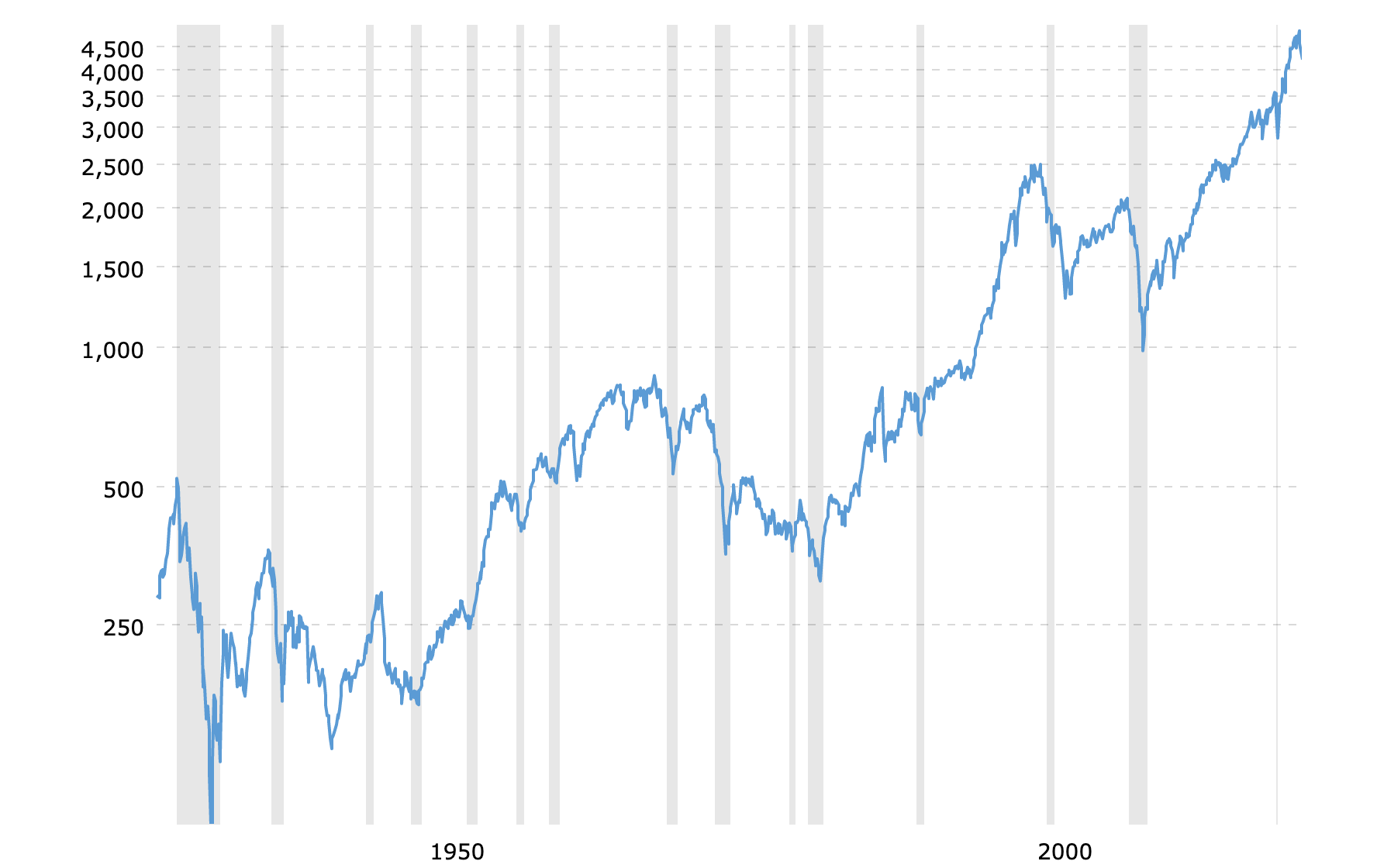

A typical financial advisor may counsel you to “Just hold on” because “It will recover”. Unfortunately, taking this “Buy and Hope” stance at the age of 60 or 65 or older can result in your stock market portfolio and your retirement being destroyed. Yes, next time will be different, because every time is different, and history does not just predictably repeat itself. To illustrate this fact, below is a chart of the S&P 500 price movements that we have had to live with since 1927.

It’s not just steep losses that can possibly ruin your retirement lifestyle. “Going nowhere” stock market activities can also be detrimental to your long-term retirement. What has happened in other developed countries can certainly happen in the USA. Below please find a chart of Japan’s Nikkei 225 stock index, an index that consists of Japan’s 225 largest companies.

After amazing growth from 1950 through the late 1980’s, Japan’s economy has experienced almost no growth for nearly 30 years, accompanied by stagnation and losses of the Nikkei 225 stock market index. There is certainly no reason that this phenomenon could not take place in our own economy.

While no strategy guarantees gains or is guaranteed to avoid losses, PFS does not advocate a Buy and Hold or Buy and Hope mantra for the stock market assets we manage

for our clients. It is our position that Buying and Hoping is simply too risky for our retired or soon-to-retire clients and is an unsatisfactory way to help ensure our clients’ retirement needs. Please know that we are constantly aware of the following 4 tenets of stock market portfolio management.

Guiding Tenets of the PFS Portfolio Management Philosophy:

The stock market is constantly changing and flexibility is a key to success.

Our understanding of where we are in the Economic Cycle will always impact our stock market decision-making process.

Defense is as valuable, if not more so, than offense. At times, it is absolutely important to be out of the stock market.

Our key stock market defense indicators are the 200 day and 300 day simple moving averages of the S&P 500. These simple yet powerful analytical tools have proven to be excellent predictors of stock market downturns. As always, prior performance does not guarantee future results and your results will vary from the charts shown on this page.

An Overview: The PFS Defensive Indicator Stock Market Strategy

For participating clients in fee-based accounts only who agree to this Strategy, we will overlay our defensive Indicator Strategy onto each PFS and client-selected fee-based stock market portfolio that we manage on a discretionary basis as follows:

In the event of up to a 5% decline of the S&P 500 index as measured by “SPY” (Spyder S&P 500 ETF) below its simple 200-day moving average, we will reduce your atrisk, as determined by us, stock market investments by up to 50%.

If SPY remains below the 200-day moving average and the 200-day moving average slopes below the 300-day moving average by up to 5%, we will reduce your at-risk stock market investments by up to an additional 25%, as measured by your original at-risk stock market allocation.

All proceeds from the above-described stock market investment sales will be invested either into US Government treasury securities or your money market sweep account.

Once SPY moves back above its 200-day moving average by up to 5%, we will use our discretion to reinvest the cash or bond proceeds back into at-risk stock market investments in an amount and percentage that we deem to be in your best interests.

Note: No investment strategy can guarantee gains and guarantee against losses. Not insured or guaranteed. You can still lose money.

Historic Results of this Strategy:

For the period from 1.1.1985 through 3.31.19, below please find some key statistics when this stock market management strategy is applied to VFINX, a mutual fund that is a proxy for the S&P 500, compared to just Buying and Holding the S&P 500 unmanaged index over the same period of time. Please note that we will not be investing in VFINX, this is for illustration purpose only. Each PFS-managed fee-based portfolio will have its own unique risk/reward features and will be properly diversified and tailored to a specific risk tolerance.

Utilizing our Defensive Indicator Strategy has resulted in smaller losses, less volatility and more money than the unmanaged Buy and Hold strategy, based upon the S&P 500. This is exactly what we are trying to accomplish for all PFS clients who are invested in the stock market with us in their fee-based accounts. Again, no strategy guarantees profits or protects from losses.

Questions on the Defensive Indicator Strategy? We would be happy to discuss the fine-tuning of the Defensive Indicator Strategy with you. Whether you are already a PFS client or not, we welcome your feedback. Please feel free to to call our office at (847) 268-3670 and ask to speak to an advisor.

Disclaimers

While we believe the information in this report is reliable, we cannot guarantee its accuracy. Opinions expressed are subject to change without notice and are not intended

as investment advice or a solicitation for the purchase or sale of any security. Please consult your financial professional before making any investment decision.

Managed portfolio Illustrations created using “Portfolio Visualizer” and relies on market performance data available through their service. [https://www.portfoliovisualizer.com]

Data Sources - US Stock Market: AQR US MKT Factor Returns 1972-1992 (AQR Data Sets). Vanguard Total Stock Market Index Fund (VTSMX) 1993+. First Trust Advisors, based on data from Morningstar, Inc.

Historical data for annual asset class returns is not 100% reliable and authoritative sources often differ on exact returns for a particular investment. Typical differences for historical asset class returns based on the data source are below 50 basis points. Data for U.S. and Canadian securities, mutual funds, and ETFs is provided by Morningstar, Inc and Commodity Systems Inc. The capital gains and dividends for ETFs and mutual funds are typically reflected within two business days of the ex dividend date.

Prior performance does not guarantee future results and your results will vary. No strategy guarantees a gain or is guaranteed to prevent a loss.

ETFs – Exchange Traded Funds – are not guaranteed investments. You can lose money.

We are taking these actions for fee-based clients only. Please meet with us to discuss if this is right for you.